Maximal Extractable Value, or “MEV”, has experienced several major innovations since 2017. The advancement has revolved around two players, Miners and MEV Searchers. One of the largest leaps forward in the MEV space was the creation of Flashbots, which was designed to democratize MEV for these two players. However, as MEV exists today, it still ignores one key participant: the User. Although this is widely accepted with Ethereum’s Proof of Work (“PoW”) consensus mechanism today, Proof of Stake (“PoS”) opens the door to redefining MEV to potentially include Users. Most of today’s MEV solutions target Miners, MEV Searchers, and even Builders as the focal point. We believe Users can and should be included in this mix as well.

This paper introduces the concept of MPSVs, or MEV Profit Sharing Validators, a novel concept that can include Users as a beneficiary of MEV, which would ultimately complete full democratization of MEV. By full democratization, I mean that Users may finally be able to earn a portion of the MEV profits because of their “choice” on where to stake. Before we get into MPSVs, however, we first need to understand: (1) the high-level MEV players today, (2) the economic market structure of MEV, (3) general Proof of Stake systems and the role of Validators, and finally (4) some game theory.

MEV Players

Maximal Extractable Value continues to be one of the areas in Crypto markets where participants can extract profit whether it is a bull or bear market. MEV refers to the extraction of value from users by reordering, inserting, and censoring transactions within blocks.

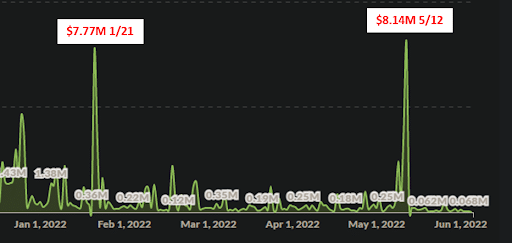

MEV can be profitable in bear and bull markets because the design space for trading strategies is broad and relatively unexplored. Participants are incentivized to continue designing new and innovative long-tail strategies to extract value given the current market dynamics. In the last 30 days ~$20M worth of MEV has been extracted on Ethereum alone according to Flashbots. Even with the Terra Ecosystem collapsing and the overall crypto market tanking, we saw one of the highest (if not the highest) Gross Profit of Daily Extracted MEV happen on May 12, 2022 for all of 2022:

*Gross Profit = Daily extracted value of successful MEV transactions without removing miner payment

Source: explore.flashbots.net

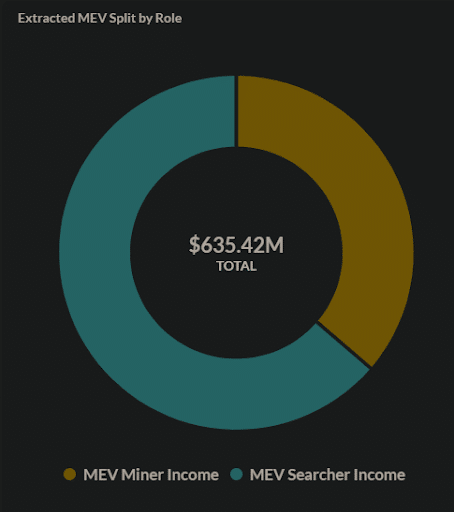

Today, there are two categories of winners in MEV: Miners & Searchers. In this world, Searchers are the dominant recipient of MEV rewards:

Source: explore.flashbots.net

Economic Market Structures & MEV

Prior to analyzing a market’s dynamics, it is important to clearly define its structure. Let’s first take a look at the overall structure of the MEV market, followed by the sub-markets of MEV Searchers and Miners.

MEV Market

What makes the MEV Market unique is that there are two participants, Miners & MEV Searchers, that work together to extract value. The overall MEV Market resembles more of an oligopoly structure when assessed holistically.

An oligopoly is a market or industry that’s dominated by a small number of large sellers or producers, and in this case, Blockspace is the commodity produced and it’s monetized via MEV. Let’s see how an Oligopoly translates to the MEV market today:

- High barriers to new entry:

- Miners: The high upfront costs of equipment, technical expertise, and capital requirements make it extremely difficult for individuals to enter the market

- MEV Searchers: Although this may not be capital intensive – the high barrier to entry comes from the technical skill, specialization, and deep understanding of DeFi, ETH & other blockchains needed to run MEV strategies.

- Imperfect Competition / Price-setting ability:

- In general, MEV Searchers & Miners will work together to maximize total Extractable Value even if it is at a cost to the User. Moreover, Miners have an advantage because they have the option to accept whichever MEV Searcher offers the highest reward – thereby making these Miners price makers.

- The interdependence of firms:

- Due to their large size and minimal competition, how a Miner structures MEV influences the action of other Miners.

- Additionally, MEV Searchers & Miners have interdependence on each other because the Searchers are the ones who find MEV opportunities and submit these to the Miners to decide whether to reorder, insert, and/or censor transactions within blocks.

- Non-price competition:

- In general, rather than miners competing on the profit split between MEV Searchers & Miners, they compete on other factors: specialized equipment, co-location, service level, as well as branding.

- Possibility of Collusion:

- Given the concentration of Miners, they can actually work together to collude in this space as well. Miners may agree amongst themselves that they will only accept a 95% split of MEV profits with Searchers. However, Flashbots addresses this issue in the current MEV market.

- Similarly, if MEV Searchers banded together they could demand a higher profit split between Miners and MEV Searchers.

MEV Searcher Market

Now that we have defined the overall MEV Market, we can also look at its sub-markets. Let’s now take a look at the MEV Searcher market.

MEV Searchers are like the “plumbers” of Blockchains. They go deep into transactions within blocks to find MEV. It is a group of artisan & specialty anons who have valuable technical knowledge on how to extract value. This dynamic has characteristics of monopolistic competition.

Monopolistic Competition (not to be confused with Monopoly) is a type of imperfect competition such that there are many producers competing against each other, but selling services that are differentiated from one another and not perfect substitutes.

Let’s see how the monopolistic competition characteristics line up with the MEV Searcher market:

- Slightly Differentiated Services:

- MEV Searchers all try to find extractable value on-chain, though the method of MEV differs from Searcher to Searcher. For example, Searchers can focus on Arbitrage, Liquidations, Sandwiching, or specialized Long-Tail strategies.

- Many Searchers:

- Self-explanatory

- Maximize profits:

- MEV searchers seek to maximize profit and therefore extract as much MEV as possible from blocks. Similar to a pure-play Monopoly, each Searcher will try to find as much MEV as possible, without being penalized by Users (generally).

- Imperfect Information:

- MEV Searchers have an informational advantage over Users, who are often relinquishing value to Searchers unknowingly.

- Consequences:

- Searchers operate with the knowledge that their actions will not affect other searchers’ actions.

MEV Miner Market

One of the core reasons the MEV Market resembles an oligopoly is because the Miner Market is an oligopoly. Given MEV Searchers work with Miners – combined together these two markets resemble more of an Oligopoly vs. Monopolistic Competition. Rather than rehashing the characteristics of oligopolies, in this section, we can calculate the Herfindahl-Hirschman Index HHI to understand the Miner Market concentration.

The Herfindahl Index is a measure of the size of firms in relation to the industry they are in and is an indicator of the amount of competition among them. It is calculated as:

In this equation, MSi is the market share of firm i, N is the total number of firms. We add the numbers to get a sense of the concentration in the industry. We square the MSi because squaring all of the weights gives greater weight to participants that have a larger share of the market.

We can use MiningPoolStats to get a sense of each Miner’s Hashrate which ultimately is a benchmark of its market share (~81 miners listed). We use the following steps:

- Convert each Miners hashrate to TH/s

- Sum total hashrate in TH/s

- Divide each Miner’s hashrate by the Total

- Square each of the values in #3

- Sum up the total of #4

If we calculate the HHI on these miners we get an HHI of about 545 or 0.545 which means that the Miner Market is highly concentrated and falls under the oligopoly market structure.

The Optimal Perfectly Competitive MEV Market

Perfect competition is an ideal type of market structure where all producers and consumers have full and symmetric information and no transaction costs.

A perfectly competitive market is characterized by:

- A large number of buyers and sellers

- Homogeneity of product

- Free entry and exit of firms

- Perfect knowledge of the market

- Sellers earn normal profit (vs supernormal profits)

In this market we reach the point where the quantity supplied equals the quantity demanded and therefore have Pareto Efficiency. Pareto Efficiency is a situation where no individual or preference criterion can be made better off without making at least one individual or preference criterion worse off.

One of the greatest innovations in the MEV space was the creation of Flashbots, which was intended to democratize MEV.

“Mitigating the negative externalities of current Maximal Extractable Value (from now on MEV) extraction techniques and avoiding the existential risks MEV could cause to state-rich blockchains like Ethereum.”

Flashbots’ 3 goals:

- Democratizing Access to MEV Revenue

- Bringing Transparency to MEV Activity

- Redistributing MEV Revenue

Flashbots has helped to level the playing field for MEV Searchers, by helping to prevent collusion and democratizing MEV. Although Flashbots democratizes MEV opportunities for Searchers, Users are still left out of the equation. One could argue that anyone is able to participate in MEV, including Users, however, we know this is unrealistic given most DeFi Users have no access to MEV.

So while MEV Searchers & Miners are both better off from Flashbot’s MEV system in a Proof-of-Work system, Users either gain nothing or are the target of the extractable value. Today’s MEV dynamics for Searchers & Miners are not enough to fully democratize MEV and move it into a perfectly competitive market. However, Proof-of-Stake might change this and ultimately lead us to a theoretically perfectly competitive market.

A New Paradigm: Enter Proof of Stake

As we all know, Ethereum is switching over to a Proof of Stake (PoS) system. In PoS, instead of miners competing with each other to validate & confirm transactions, “validators” are randomly selected to verify transactions based on a Leader schedule.

Proof-of-Stake (PoS) is a cryptocurrency consensus mechanism that requires you to stake coins, or set them aside, to be randomly selected as a validator.

What fundamentally breaks the oligopolistic competition in Proof of Stake is that Users are able to decide which Validators to stake assets with, which may impact Leader selection or stake-weight (more on this below).

We may be able to take some lessons from Solana on how Users can potentially take part in the proceeds of MEV and benefit from “extractable value”. What changes the game for Users in Proof-of-Stake is that they decide where to stake their tokens, which opens the door for MEV innovation. The more stake-weight a validator has – the higher its chance of getting selected as a Leader.

Before jumping into how it might help to understand some basic information about validators on Solana.

Solana Consensus and Validators

Solana uses Proof-of-History, its own novel Proof-of-Stake consensus mechanism. Solana’s network infrastructure is made up of Validators & RPC nodes. Validators are the backbone of Solana’s network, responsible for processing transactions and participating in consensus. Validators are the “consensus nodes” of the network, meaning they validate transactions, vote on blocks, and drive the consensus mechanism of the Solana network. Running a Validator (or an RPC node) requires a dedicated bare metal server with high-end specs.

From Solana’s documentation regarding the Leader Schedule Generation Algorithm (pay attention to #3):

Leader Schedule Generation Algorithm

The leader schedule is generated using a predefined seed. The process is as follows:

- Periodically use the PoH tick height (a monotonically increasing counter) to seed a stable pseudo-random algorithm.

- At that height, sample the bank for all the staked accounts with leader identities that have voted within a cluster-configured number of ticks. The sample is called the active set.

****************************************************************************** - Sort the active set by stake weight.

****************************************************************************** - Use the random seed to select nodes weighted by stake to create a stake-weighted ordering.

- This ordering becomes valid after a cluster-configured number of ticks.

Today, Validator Rewards are in 3 categories:

- Protocol Based Rewards: Issuances from a global, protocol-defined inflation rate – where rewards are delivered on top of transaction fees earned.

- Staking: Stakers are rewarded for helping to validate the ledger. Users benefit from staking as they can delegate their stake to validator nodes. The validators do the legwork of replaying the ledger and sending votes to a per-node vote account to which stakers can delegate their stakes. The rest of the cluster uses those stake-weighted votes to select a block when forks arise.

- Stake Pools – these are liquid staking solutions that help promote censorship resistance and decentralization, examples include Marinade Finance as well as Lido.

Today Staking yields are based on the current inflation rate, the total number of SOL staked, and individual validator uptime and commission. A validator’s commission fee is the percentage fee paid to validators from network inflation. Validator uptime is defined by a validator’s voting.

In other words, the rewards for staking come from Solana’s inflation schedule. Validators offer staking rewards to Users but Validators may also charge fees/commissions to Users as well. What if we could increase the reward piece beyond the standard inflation level in a way that benefits everyone?

Users are able to stake with the Validators that they prefer, and are also able to switch to other validators if they want, which takes anywhere from 2-4 days on Solana. Additionally, with solutions like Marinade’s liquid mSOL, users are able to immediately unwrap their mSOL tokens for SOL in real-time. This creates an interesting competitive dynamic between Validators. Users will select Validators that give them the highest starking rewards as well as Validators that charge the lowest fees/commissions.

Ceteris paribus, users will choose the Validator with the highest return and lowest fees.

Here is where things get really interesting! The more SOL a Validator is able to pool together and stake, the higher stake-weight the Validator is able to get. The more stake-weight the Validator has, the higher its chances of being the Leader. Think of it as a Lottery System where the more stake-weight a Validator has – the higher chance it has of being selected as a Leader.

MEV on Solana Today

Today, most of the MEV extracted on Solana goes to MEV Searchers. For reasons that are beyond the scope of this article, a large portion of MEV on Solana comes from bots spamming the Solana blockchain non-stop trying to find arbitrage opportunities or front-running NFT launches. Because the cost of transactions on Solana is extremely cheap, running bots is an easy strategy to capture MEV opportunities.

Future MEV on Solana

Now, one way to break the loop of these spam bots is to set up a sealed bid state auction such that highly contentious resources are more expensive than others to acquire locks for. On Solana, Jito Labs is building the sealed silent bid auction to enable searchers to essentially bid on blockspace. Benefits of this include being able to have MEV transactions run off-chain in some kind of public mempool (which Solana currently does not have). Transactions sent through Jito would be prioritized, and the rewards split with Validators, similar to Flashbots. Benefits of this include:

- Killing spam bots – who are no longer able to find meaningful MEV because they are not prioritized transactions

- Better User Experience

- Helping to unclog the Solana network and allow it to run more efficiently

So how can we fully democratize MEV and move it towards a perfectly competitive market?

User Choice!

Enter MPSVs, The Future of Efficient MEV Markets

Some fascinating game theory happens when MEV Searchers are able to work with Validators to extract MEV. One optimal outcome is that Users are finally able to passively earn a portion of MEV rewards, BUT HOW???

********************************************************************************

MPSVs = MEV Profit Sharing Validators

********************************************************************************

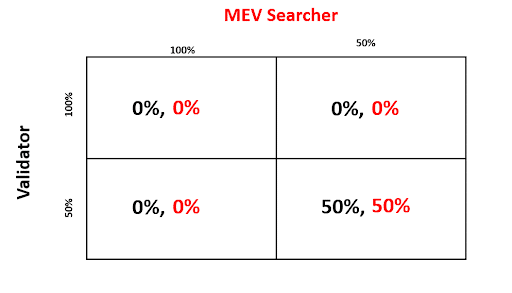

Let’s first explore two game theory exercises. The first game is trivial but let’s just run through it. Should Validators and MEV Searchers share rewards? For simplicity, let us assume the following: there is only ONE MEV Searcher and ONE Validator.

- As I mentioned the case is trivial, because in the case that either party does not want to share any kinds of rewards and wants to keep 100% of MEV extracted, neither would ever agree to work together. The optimal solution in the above chart is splitting the profits between MEV Searchers and Validators. Though the 50% is somewhat arbitrary it is in everyone’s best interest to work together. Whether it is a 60/40, 90/10, etc. split is irrelevant – they must work together.

- It is clear that there is an interdependency between MEV Searchers & Validators for the MEV Market. One cannot exist without the other.

- In the long run we may see a world where Validators bring MEV Searchers in-house or start running MEV strategies themselves – leaving only exotic forms of MEV available for Searchers.

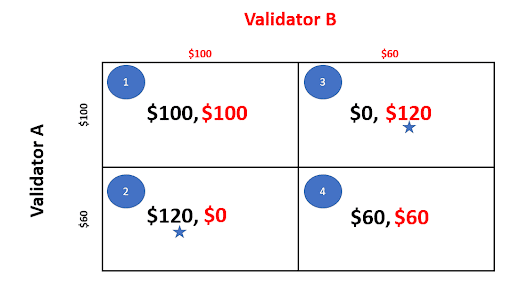

The next case is a bit more interesting. We’ve established above that there will be some profit share between Validators and MEV Searchers. Now we ask, should the Validators themselves decide to share any MEV profit with Users staking on their platform?

Let us assume the following:

- The interdependency of MEV Searchers & Validators has been established as per Game 1.

- Now there are two Validators: Validator A and Validator B

- Both start out with an equal amount of stake-weight (i.e. the same amount of staked assets)

- Users are economically rational aka Users will choose to stake with the Validator that offers the highest reward

- Validator A and Validator B each decide on how much MEV profit they want to share with their respective Users

- If a Validator loses its Users, it can no longer be a Leader (given all of its tokens have moved to another Validator)

- If a Validator loses its Users, it no longer receives any MEV transactions from Searchers and instead, the MEV transaction goes to the other Validator

- Assume MEV generated is uniform and constant i.e. there is $100 worth of MEV for each Validator and the numbers outside the box represent how much profit each Validator decides to keep.

- We are assuming the long-run cases, not the short-run.

Now let’s walk through each scenario in every box.

- A = B.

Validator A sets its MEV profit at $100 (User A profit = $0).

Validator B sets its MEV profit at $100 (User B profit = $0).

Users total profit = $0.

Both Validators take home $100 each and Users get nothing. - A < B.

Validator A sets its MEV profit at $60 (User profit = $40).

Validator B sets its profit at $100 (User profit = $0).

Users earn $40 per MEV transaction (total of $80).

In the Long Run, Users from Validator B leave and Validator B ends up with $0 profit.

Meanwhile Validator A gets the additional MEV transaction and earns an additional $60 ($60 + $60 = $120). The logic is as follows:- Long Run

- Again Users are rational, and because Validator A is offering a higher staking return – Users move their funds to Validator A and abandon Validator B over time.

- Because Users move all their staked assets to Validator A, Validator B no longer has a chance of being a Leader and no longer receives MEV transactions from Searchers.

- *The MEV that was supposed to be generated for Validator B flows into Validator A – which offers the same level of profit i.e. $60 + $60 = $120.

- This ultimately drives Validator B’s MEV profit to $0.

- A > B.

The logic in #2 above applies. - A = B.

Validator A sets its MEV profit at $60 (User A profit = $40)

Validator B sets its profit at $60 (User B profit = $40)

Users earn $40 per MEV transaction (total of $80).

In this case, Users from A stay where they are AND Users from B also stay where they are. No Validator is abandoned.

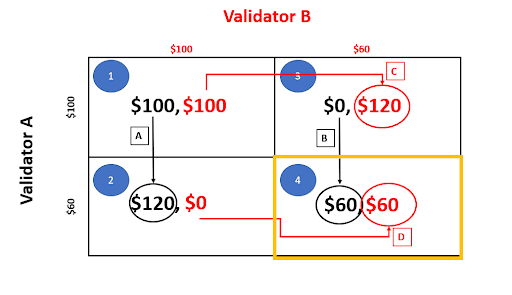

The MPSV Nash Equilibrium

The Nash equilibrium is a decision-making theorem within game theory that states a player can achieve the desired outcome by not deviating from their initial strategy. In the Nash equilibrium, each player’s strategy is optimal when considering the decisions of other players.

We can see from the chart above that if both Validator A and Validator B set profits equal to each other, they will both be better off than if they set profit at the higher level i.e. Box 1 instead of Box 4. But the question remains, is Box 1 the outcome we can expect? In order to solve this let’s first find the responses for both Validator A and Validator B:

Similar to the above let’s step through each response starting with Validator A:

- A. For Validator A, if Validator B sets her profit at $100 then Validator A has two choices of profit (Box 1 vs Box 2):

- $100 if Validator A sets profit at $100

- $120 if Validator A sets profit at $60

- Given Validator A is economically rational – it will set its profit at $60 which will yield $120 in total profit.

- B. For Validator A, if Validator B sets her profit at $60 then Validator A has two choices of profit (Box 3 vs Box 4):

- $0 if Validator A sets profit at $100

- $60 if Validator A sets profit at $60

- Given Validator A is economically rational – it will set its profit at $60 which will yield $60 in total profit.

- Notice in both cases above setting profit at $60 instead of $100 is a dominant strategy for Validator A. Validator A setting profit at $100 is never the best response.

Validator B:

- C. Box 1 vs Box 3:

- Given Validator B is economically rational – it will set its profit at $60 which will yield $120 in total profit.

- D. Box 2 vs Box 4:

- Given Validator B is economically rational – it will set its profit at $60 which will yield $60 in total profit.

The Nash Equilibrium: For both Validator A and Validator B there is only one potential outcome where both Validators are best responding and that is if both Validators set their profit at $60 (yellow box in the diagram above). This will be the sole Nash Equilibrium and they will each earn a $60 total profit.

Thus we have shown above that in the case where Users are able to move their staked assets fluidly amongst Validators, the Nash Equilibrium occurs when Validators offer the most attractive profit-sharing split that is beneficial to Users, similarly to how perfectly competitive markets operate:

This is what gives rise to MPSVs = MEV Profit Sharing Validators.

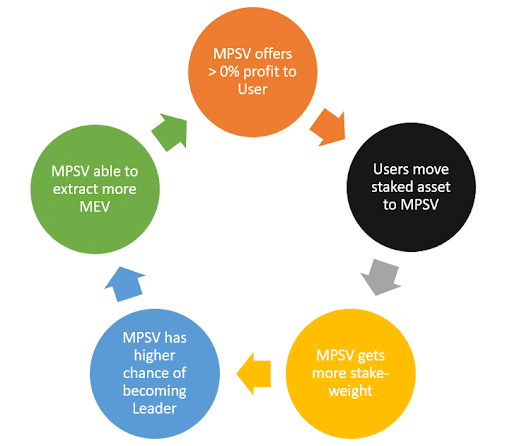

The MPSV Flywheel

Proof of Stake gives Users the ability to decide where they want to stake their assets. Ceteris paribus, having more stake-weight allows you as a Validator to be the Leader in the PoS model. For rational economic actors, deciding where to stake comes down to where you can earn the highest APY with the lowest fees/commissions.

Using proceeds from MEV, an MPSV that has a lower stake weight may be able to offer a portion of MEV profits back to users to boost yield above the standard rate of inflation. Additionally, if smaller MPSVs pool their MEV profits together – it gives room to even more staking yield for users. Over time, new users will shift to the MPSV model (that is, offering MEV profits to Users) and thus, this Validator will be able to capture additional stake-weight from other Validators. This, in turn, leads to the MPSV being selected as a Leader more often.

Conclusion

Wrapping this all up, we can see that there is a scenario with Proof-of-Stake MEV whereby everyone is actually better off, including Users. In a Proof-of-Work system – Miners act independently of Users when it comes to confirming blocks. In a Proof-of-Stake system, there exists a dependency between Validators and Users.

This is what I mean when I say “fully democratizing MEV”. We have shown above that the Nash Equilibrium for MPSVs occurs when the most attractive profit is shared with Users across different validators. All it takes is one Validator to offer a better MEV profit share with Users to move the Validator market in the long run.

We believe MPSVs can serve a few functions:

- Create a new shift in MEV where Users can benefit from MEV passively

- For smaller MPSVs, this could serve as a way to compete with larger Validators if they are able to share more profits with Users vs. say the Top 10 or largest Validators – or even band together and pool MEV profits with other small MPSVs.

- In the extremely competitive case where all Validators pass on 100% of their MEV share of profits to Users, Users end up benefiting overall. [Note: Validators still can make revenue via transactions & priority fees].

- Everyone is better off in this world including MEV Searchers, Validators, and Users in this model.

What breaks the Oligopoly of the MEV Market is User Choice!

And maybe, just maybe, we transform the MEV market into a Perfectly Competitive Market Structure.

If you’re building something in the MEV space or want to generally talk about MEV with us, please reach out. DMs are open!

Tweet

Ali Sheikh

Principal

Ali has been in Crypto since 2015. A crypto enthusiast at heart, Ali has been part of Defi Summer, Solana Summer, NFTs, Yield Farming, DAOs and much more. As part of Reciprocal’s interest in cryptocurrency, Ali is actively investing in people working on Web3 Applications, Decentralized Finance, and Infrastructure.

Prior to joining Reciprocal, Ali was a software engineer at Flexport where he also focused on marketplace and analytics. Before this, he spent time on the venture investment team at Cisco covering the Internet of Things. He also spent time in the mobile gaming industry leading User Acquisition and Growth. Ali started his career at Morgan Stanley in the investment banking division.

Ali received his B.A. in Economics from the University of Chicago and is currently pursuing a master’s in computer science from the University of Pennsylvania.

When he is not spending time in crypto, Ali can be found on hike paths, boxing, or exploring nature with his young daughter.